On Wednesday, we held a webinar that focused on helping our clients understand ACH payment options and how they can use them to their benefit. In this article, I’ve summarized the main takeaways from the 40 minute presentation.

The webinar was presented by Christian Arntsen, who is foreUP’s Sr. Product Manager. In his role he has been highly focused on our Billing platform, and managing the build and implementation of our ACH offering over the last 18 months. He is the house expert on these features, and has worked hand-in-hand with pilot users to make sure the tool can actually drive value for our clients.

- Billing Premier

- Accounting

- Passes

This year, Christian’s goal is centered around driving revenue for businesses in the industries we serve. As a product manager, his job is to work with our clients to identify the biggest opportunities. He then prioritizes projects and gets them on our Development Road Map. At that point, he works through the build and implementation with pilot users. From there, he works to track the success, optimize where needed, and deploy the product/feature launch.

We have some exciting projects lined up, and ACH is just the first of many that we will introduce in order to accomplish this.

The webinar will focus on:

The webinar will focus on:

- Fundamentals of ACH

- How to know if it’s the best option for your business

- The values of foreUP’s ACH offering

- How to use it successfully

- Tips and tricks from other courses that have used ACH successfully

- Live demo of how ACH works for you and your members

- Q&A

What is ACH?

ACH stands for “Automated Clearing House”. It essentially allows you to move money between bank accounts without the use of checks, cash, money orders, wire transfers, etc. It has become one of the most popular ways to pay for services or goods.

Venmo is an example of an ACH network platform. Money travels from the customer’s bank account, to the Venmo account, then to the receiver’s bank account.

This is very similar to how foreUP ACH works. Your customers send money directly from their bank account to the ACH account you create, where that money will be sent to the bank account you have set up for your business.

Since the summer of 2020, we’ve worked with over 100 businesses. We’ve seen explosive growth and excellent adoption, and we’re now excited to see how that will transition to you.

Is ACH right for my business?

“Modernizing” Your Business

As mentioned, it’s becoming more and more mainstream in the consumer world. Most people use ACH to pay for one of their subscriptions, if not all of them. The Federal Reserve Payment System released their annual study in January on last year’s payment trends. It shows that ACH transactions have been increasing 6-7% over the last four years, with no end in sight.

There’s a reason for this. Companies don’t want to be gouged by processing rates, so they force consumers to use them. And now, because it’s becoming even more common, ACH is a payment option that is almost expected by consumers.

We asked webinar attendees the question:

Poll: Have you ever had customers ask if ACH payments were an option for your facility?

33% Yes

46% No

21% Unsure

A common response Christian gets when he talks to our customers is that they believe ACH is just for the “big dogs”, and they don’t see it providing any value for their business. “None of our customers are asking for it.”

Yet, when Christian asks whether or not they have any interest in offsetting their credit card processing fees, the answer is consistently YES.

Reducing Processing Fees

We found that the average CC rate is about 3.5%, and can go up frequently to the high five or sixes. With foreUP ACH, the rate is only 1%.

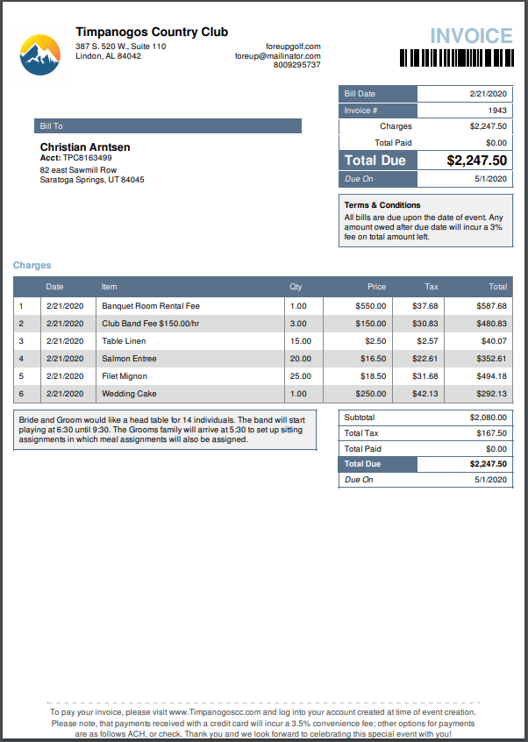

While ACH is commonly adopted first by businesses that have recurring monthly payments (like Netflix, gyms, or country clubs,) the value is still very high for one-time payments. We have many courses that are using ACH for event payments.

Say it’s just a normal event, like a tournament party or wedding. These can be thousands of dollars! If customers are choosing to pay with a credit card, you’ll have to pay the processing fees. This is why we have facilities that are offsetting these fees by implementing ACH for major event payments.

Some customers are utilizing “invoice footer notes” to let their customers know that they can go online and pay their ACH now to avoid any credit card processing fees.

So really, ACH is definitely for anyone who wants to offset processing fees.

foreUP is Processor Agnostic

This means that, no matter who you are processing credit cards with, foreUP ACH will work for you. In fact, you don’t even have to be using a credit card processor to be using ACH!

Benefits of ACH

Staying “up to date” with the times and technology is just a small piece of the pie in terms of benefits. The monthly savings speak for themselves.

Staying “up to date” with the times and technology is just a small piece of the pie in terms of benefits. The monthly savings speak for themselves.

Extra Spending Cash

One of our pilot users had processing rates that were in the high-5%, low-6% range! Through foreUP ACH, they are on track to save thousands of dollars a month by using the feature.

Christian loves to ask what users are doing with the savings, and this particular business told him they are using the spare cash to make much anticipated renovations and improvements to their facility. This is the course we did a case study on, which you can take a look at to see what the savings could look like for your business.

Next-Day Processing

Our biggest competitive advantage with our version of ACH is that you receive the funds the next day. This is not standard for ACH platforms; most ACH providers take 6-11 days to deliver the funds to your bank account.

Somebody pays their bill on the first of the month. After seven days, the business finds out that the customer’s payment failed due to insufficient funds. That business is now tracking down that customer, asking them to make sure they deposit funds so it can be tried again. The customer uploads the funds and tells the business they can try the payment again. Once it’s been processed a second time, the business has to get through the waiting period again before they know whether or not the payment was successful. One user was especially excited about this feature. Here is how they lay out a scenario for Christian:

With next-day processing, the whole process—even with a failed payment—would take less than four days. In the scenario above, the episode could last well over two weeks.

Security

ACH is completely secure. foreUP is not storing anyone’s bank account information in our system. You don’t have to worry about an employee being privy to your customers’ information, or even your own bank account information.

Improved Guest Experience

This is a critical component for businesses in the hospitality industry. Without it, you’re just another business.

So when it comes to paying a bill, it’s important to give your guests every payment option you can. Because it can be assumed that nearly all of your customers are using ACH for other payments in their lives, it’s an easy assumption for them that you also offer this option.

Automated Communication

We have also built many new features that automate communication between customers, businesses, and the respective ACH transactions.

When a customer makes an ACH payment, they will receive an email notification that tells them they completed the payment. Likewise, they will also receive an instant notification if their payment fails. Rather than you having to reach out to them, they will be the first to know that they need to address the missed charges. This allows them to avoid additional fees and hassle that come along with failed payments, which is in turn another checkmark in the guest-experience box.

No Expiration!

Last month we processed about 43,000 statements. You wouldn’t believe how many of these payments have failed due to an expired credit card. With ACH, this doesn’t happen. Long gone are the days of trying to stay on top of whose cards will be expiring.

Last month we processed about 43,000 statements. You wouldn’t believe how many of these payments have failed due to an expired credit card. With ACH, this doesn’t happen. Long gone are the days of trying to stay on top of whose cards will be expiring.

Improved Business Experience

Business experience, while maybe not quite as critical as guest experience, is very important. foreUP ACH is totally integrated into your system, which means all the financial reports you need are in foreUP. The support you need is managed by foreUP’s success representatives, not some financial call center. (And remember, our wait time is less than a minute.)

All of the information you need is located right there in the foreUP system, so you can easily access the data and use it to make your business decisions.

Adoption

Turning on ACH does not mean you will automatically start receiving next-day funds. Getting the most out of this tool will require a bit of work on your part, because you still need to make your guests or members aware of this new payment option and encourage them to get it set up. (Fortunately, it’s incredibly simple.)

This is another area where we have you covered. We’ve worked with courses over the last year to find out what operator concerns were as well as their customers concerns. With this information we have built tools to help you convert as many of your customers as possible over to ACH. We’re committed to making this work for you, because we believe it’s a no-brainer that will make you money.

Customer Training Video

This is just a 1-2 minute video that tells customers how to set up ACH on their own. You can send this video out to your customers in an email blast, on your social accounts, or in a newsletter.

PDF Printouts

This is just a one-page document with images that provides a 1-2-3- step guide to setting up ACH. We saw this work very well with some of our country clubs that had an older demographic and didn’t enjoy the digital notifications as much. They printed out and folded up this guide in their snail-mail newsletter.

New Design Interface

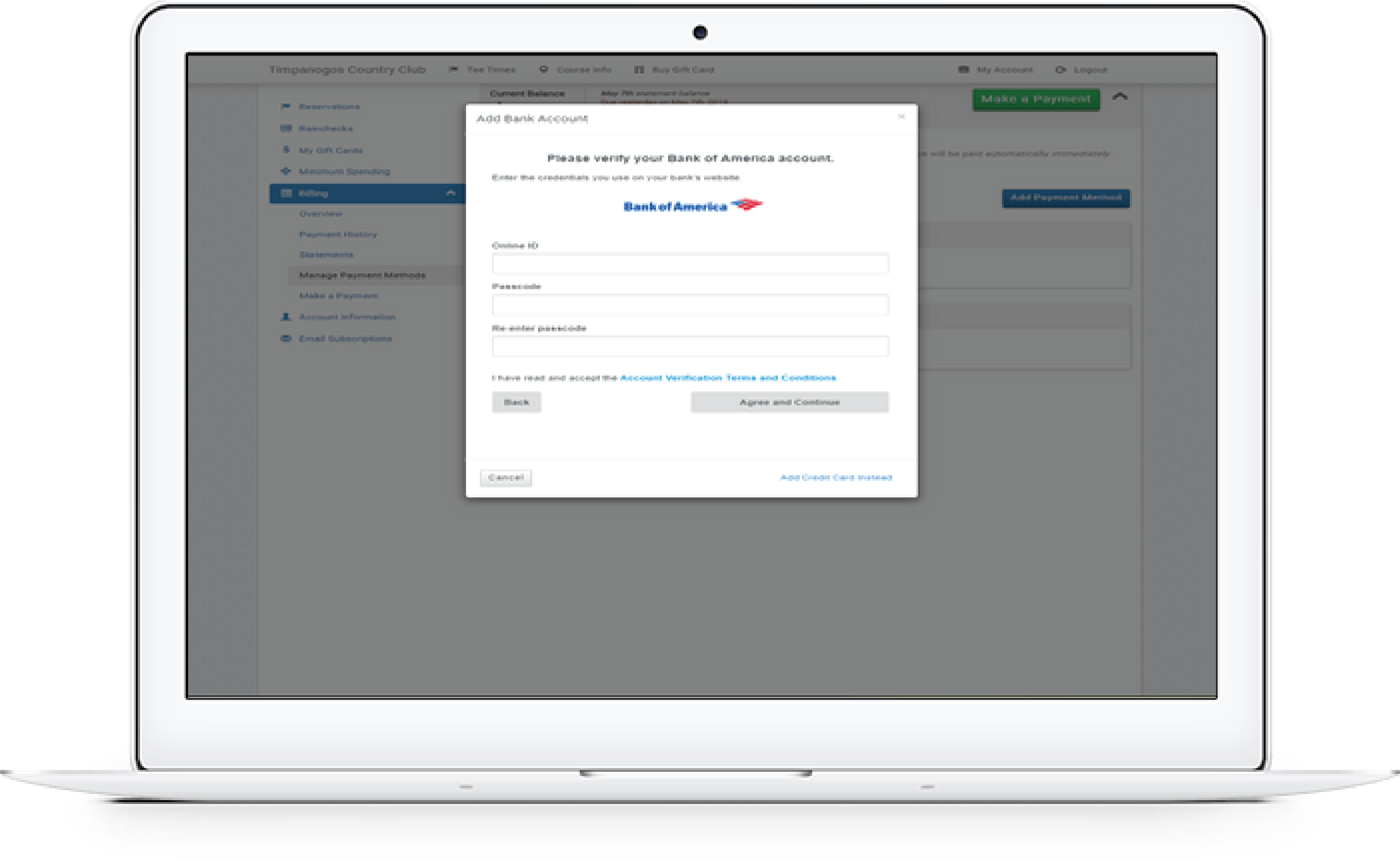

We want this to be as straightforward as possible, so we made it as simple as we could for customers to get set up.

Marketing Templates

For those of you using our email marketing, we have created custom templates that you can use.

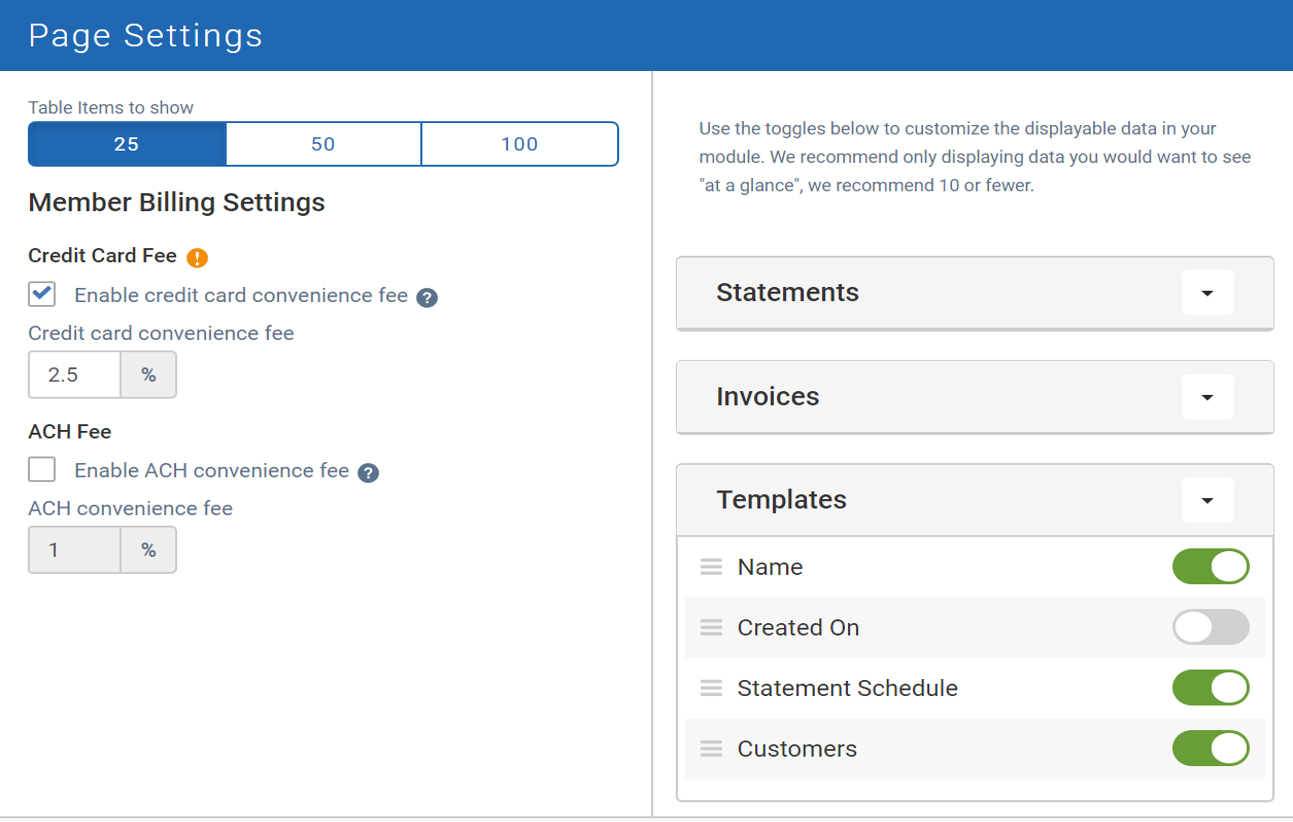

Convenience Fees

This is a big enough feature that it needs its own section, but it is definitely a tool that encourages ACH signups.

Convenience Fees

With ACH comes the ability to charge customers a fee when they use a specific payment method (i.e. a 2.5% convenience fee when they pay with a credit card.) This fee is very common for businesses that are trying to move away from credit processing.

With ACH comes the ability to charge customers a fee when they use a specific payment method (i.e. a 2.5% convenience fee when they pay with a credit card.) This fee is very common for businesses that are trying to move away from credit processing.

As soon as you turn on ACH, this feature allows you to offset 100% of card fees if you want to. Of course, this is a completely optional ability, but the feedback we’ve received from users is very positive. Their customers are showing an interest in quickly activating ACH, or dealing with the CC fees without objection. You can also use it to offset the 1% ACH fee.

*Charging convenience fees is not allowed in 11 US states. We are currently working on a solution for our customers in those regions.

Live Demo

At this point in the webinar, Christian pulled in his own screen and did a walkthrough of how you go about setting up ACH, but he also showed you what your customers will experience as they set up ACH on their end.

You can see the demo in the videos that follow.