Jim nervously opened the email from his credit card processor, with the subject line STATEMENT AVAILABLE. He pointlessly hoped that this month’s fees would be lower, but he still clenched his teeth when he saw the average fee. “3.8%?” he thought. “That seems really high!”

Most course managers and operators experience something similar to what Jim felt every time they look at their processing fees, if they can even figure out what they’re being charged. Credit card fees can cost courses and clubs up to $60,000 per year, and often cause huge headaches because of delays in processing.

There’s good news, though: you don’t have to deal with that.

This week, foreUP released an ACH processing feature that will immediately save courses thousands of dollars and create a better experience for operators and customers alike.

What is ACH?

ACH payments are electronic payments that draw directly from the customer’s checking or savings account. Because it comes directly from the account to the course, ACH payments avoid the expensive processing fees that credit cards incur.

foreUP ACH Features

– Lower Processing Fees

– Customizable Convenience Fees

– Quick Payment Processing

In contrast to the exorbitant fees that most courses pay for credit cards, foreUP ACH only  charges 1% per ACH transaction. This can easily be offset through a convenience fee charged by the course to the customer for using foreUP ACH.

charges 1% per ACH transaction. This can easily be offset through a convenience fee charged by the course to the customer for using foreUP ACH.

Courses can both incentivize their customers to switch to ACH and recoup processing fees by setting a convenience fee that matches the credit card processing fee.

Courses can both incentivize their customers to switch to ACH and recoup processing fees by setting a convenience fee that matches the credit card processing fee.

Using foreUP ACH can also prevent delays in payment. foreUP ACH payments are processed within 1 business day, whereas competitor ACH processing can take up to 10 days to go through the system. This often a problem for small courses (or even large ones) who need timely processing to cover their expenses.

Using foreUP ACH can also prevent delays in payment. foreUP ACH payments are processed within 1 business day, whereas competitor ACH processing can take up to 10 days to go through the system. This often a problem for small courses (or even large ones) who need timely processing to cover their expenses.

{{cta(‘f91d67ea-bd5a-497a-bc28-7be50e202940′,’justifycenter’)}}

How Do I Set It Up?

Setup is very simple and can take as little as 3 minutes to get started. We’ll give you a step-by-step walkthrough below:

Go To Billing

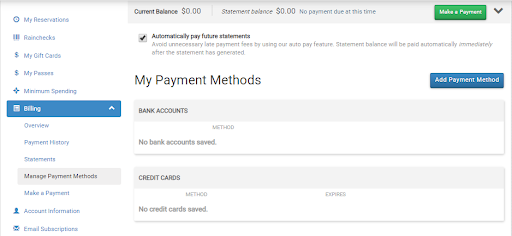

Enter the “Billing” module in foreUP and select “foreUP ACH” from the dropdown menu on the top right of the module.

Enter Your Business Information

A pop-up menu will prompt you to enter in what type of business you are, as well as some other details.

Enter Additional Information

Depending on what type of business you are, you may need to certify ownership.

Wait For Verification

Once the business information is submitted, the system will automatically verify your business in as little as 3 minutes. Once that’s done, you’ll receive an email informing you that you can move on to the next step.

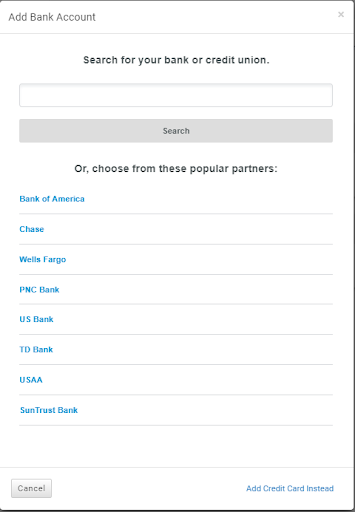

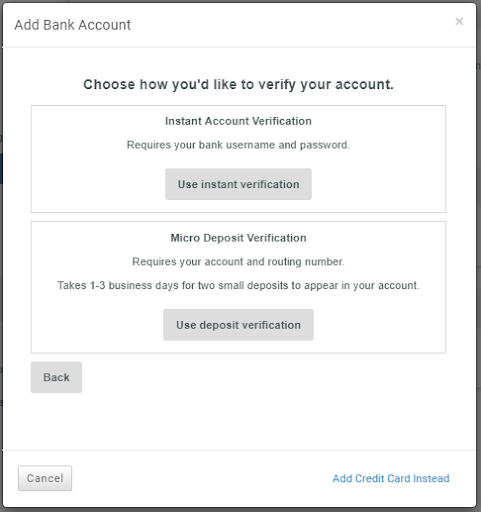

Connect Your Bank or Credit Union Account

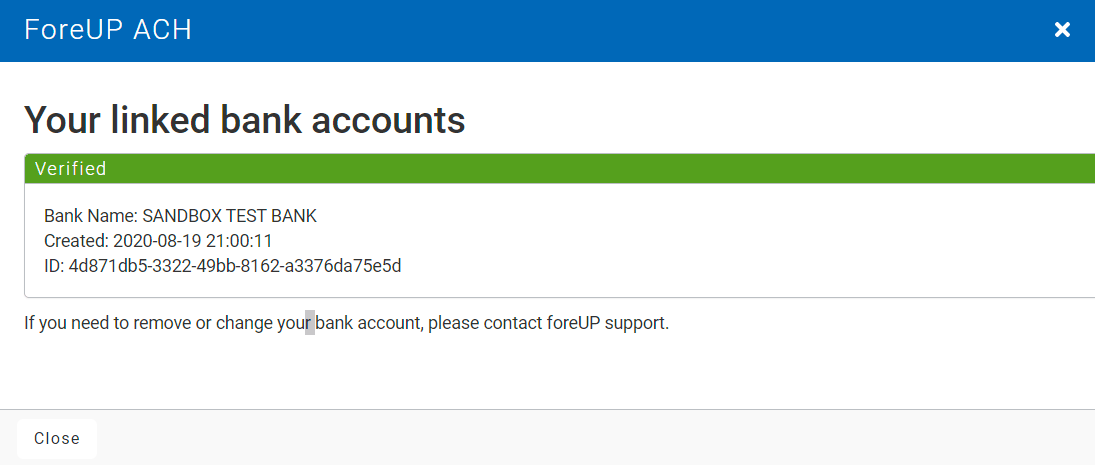

When you click back into the “foreUP ACH” option in the dropdown menu, this screen will appear, prompting you to fill in your bank information. This is a completely secure site, and you can put in your information, including your username and password when prompted, without fear.

Finish Setup

Once the setup is finished, you’ll get an email notification. When you go back to the “foreUP ACH” menu option, you can see a summary of all the linked accounts, and you can also link more accounts.

What Does This Mean for My Club or Course?

foreUP ACH can save your company thousands of dollars every month, both through a lower processing fee and the inclusion of a convenience charge for use of the online billing portal. This will also save you the headache of dealing with long setup times and delays in receiving payment.

If you decide to use the ACH, you can easily get the word out to your customers about the changes through templated emails that are already published in foreUP Marketing.